Japan has a really strong economy in the 1980s, however, most of the economy is a bubble. The stock market also created a lot of bubbles due to the increase of the land price in Japan. The monthly performance of Nikkei 225 in 1984, the index largely moved within the 9900-11,600 range. Nevertheless, this isn’t the top, as the land price is still rising, the Nikkei 225 past 13,000 by December 2, 1985. Because of the bubble Nikkei increase to 38,915.87 December 29, 1989, before closing. However, as the crazy increasing of the stock price the bubble the stock prices had officially collapsed by the end of 1990. This downward trend continued through the 1900s as the Nikkei 225 opened as low as 14,338 on August 19, 1992.

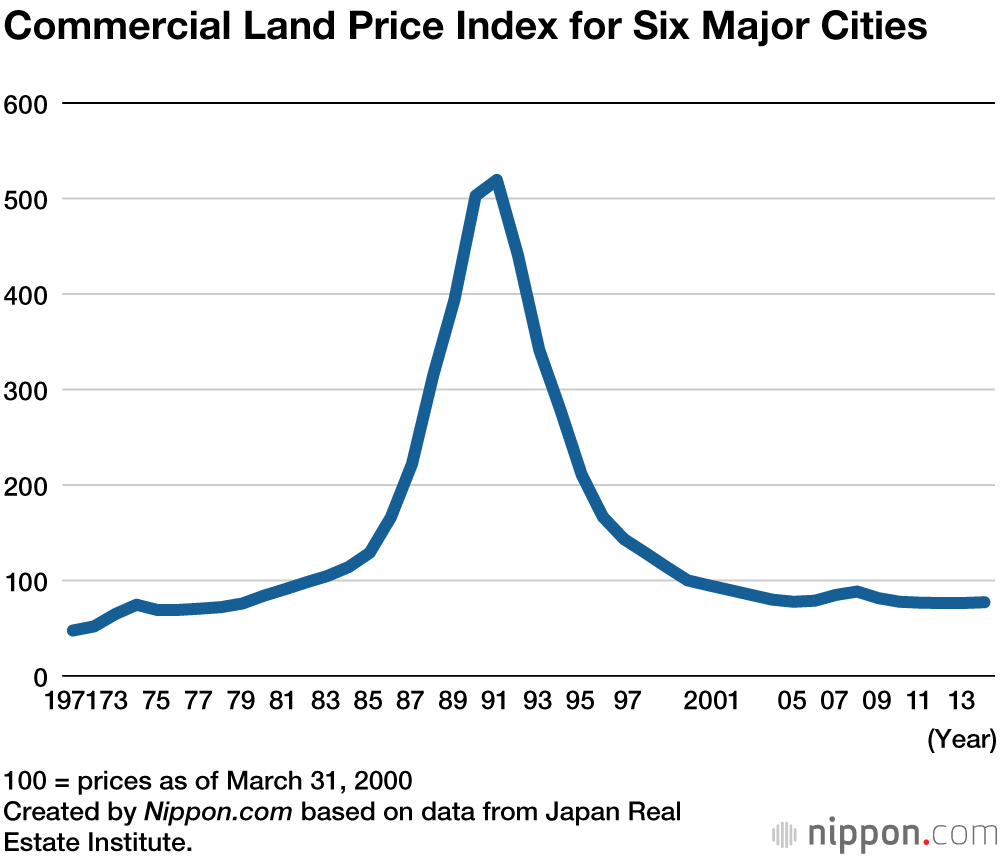

In 1990, the asset prices in the Tokyo metropolis stabilized from moving downwards. All other major urban lands in Japan remained in an upward trend. Even though it still seems okay at that year, but just one year after the asset bubble quickly explodes. By 1991, commercial land prices rose 302.9% compared to 1985, while residential land and the industrial land price jumped 180.5% and 162.0%, respectively, compared to 1985. Nationwide, statistics showed that commercial land, residential land, and industrial land prices were up by 80.9%, 51.1%, and 51.7%, respectively. By 1992, urban land prices nationwide declined 1.7% from the peak. However, the impact was worse for land in the six major cities, as the average land prices dropped 15.5% from its peak.

This damage to the bubble took Japan 20 years to recover.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.