During The New Rules of the Game (part 1), we learned that Japan suffered an economic crisis. After WWII, Japan’s economy had the largest per capita GNP during the 1980s. This economic growth led to increased speculation and stock market and real estate valuations, otherwise known as an asset bubble. An asset bubble is when the price of an asset becomes over-inflated. Prices rise quickly over a short period but are not supported by the underlying demand for the product itself. Just before the bubble bursted, the Japanese Financial Ministry raised interest rates and the stock market crashed. Banks held $1 trillion in bad debts, and Japan’s economy had fallen into a deep economic slum. This led to the Lost Decade: a period of economic stagnation.

The slow economic growth during this time affected the entire Japanese economy. During this time, Japan’s GDP averaged around 1.2%, which was much lower compared to other countries. A majority of property values have not yet recovered, and Japan will likely continue to experience negative effects of the Lost Decade.

People blame the misguided government policies during the asset bubble, but there is still much debate and possible factors to this economic crisis. Some people believe that Japan was in a liquidity

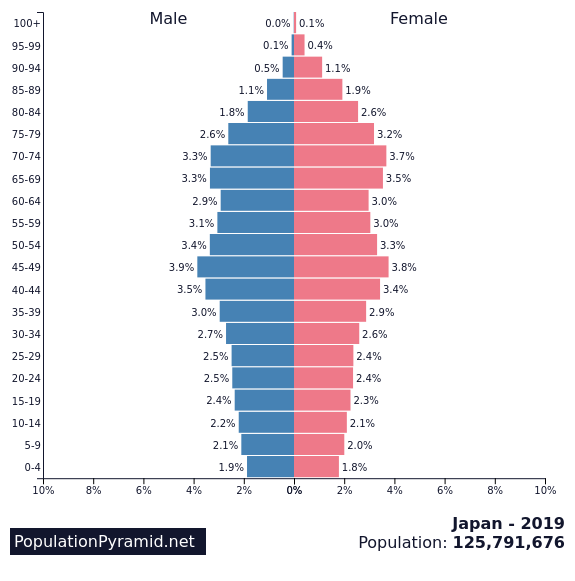

trap where consumers held onto their savings, leading to low product demand and a declining productive capacity. Others believe that a decrease in household wealth is the cause. Or perhaps the economic slowdown is due to Japan’s current population. According to the 2019 population pyramid of Japan, the base—the younger generations—is narrow. This indicates a dropped birthrate and that people are aging out of the workforce. A shrinking workforce is not good for the economy either.

Japan’s Lost Decade has also been used as a term to describe the recessions prompted by the Dotcom bubble (2000) and the housing bubble (2008) in the US. During this time, there was little to no net job growth and the US lost more than 33% of its manufacturing jobs. After financial stimulus backed by the Obama Administration and the Federal Reserve, the US economy started to recover. However, in 2019, the trade war with China has brought the US back to the brink of recession. This has been considered a major global issue and is eroding the global economy.

I think it's interesting how you explored the further possible underlying causes of the economic crisis in Japan that the video didn't discuss. It's also interesting how you connected that event to Japan currently, and also to the recessions in the US both in the past and in the possible near future. A few articles I've read stated that China is currently attempting to avoid what happened to Japan in the past, so it is important to understand how the two events/circumstances could be similar or different.

ReplyDeleteI think it is important to consider the very low interest rates in Japan. The Bank of Japan is incentivized to keep interest rates low in order to pay back debts. However, then people expect interest rates to stay low and even fall, or that currency will be deflated. When interest rates rise, consumers stop buying and just wait for prices to fall. This results in the liquidity trap Carrie mentioned, where interest rates are low, saving rates are high, and the market remains stagnant.

ReplyDeleteSource: https://www.thebalance.com/japan-s-economy-recession-effect-on-u-s-and-world-3306007